- Harsh Reality Newsletter

- Posts

- Seventh Edition - Harsh Reality Newsletter

Seventh Edition - Harsh Reality Newsletter

Banks Are Dropping Like Flies! So it goes..

Happy Saint Patrick's Day weekend! It's always nice when the international day of drinking falls on a Friday. Erin Go Bragh!

Happy St. Paddy's Day - Credit Tenor

Today is the seventh edition of the "Harsh Reality" newsletter! If you're new here, welcome to the fight. If you want to see previous editions of the newsletter they'll be available at the link below. We have added Twitter to our social media portfolio so please follow us there. Not sure if it's worth $8.00, but our founder will be the only one tweeting under the nom de guerre "@HarshActual." Also, if you want to join us on our Discord server or view our YouTube shorts click on the links below. Our intent is to always provide more value than we extract so thank you for being here and enjoy the show.

Weekly Dose of "Harsh Reality"

This week three banks in the United States collapsed, and Credit Suisse is on the brink. The market sentiment shows that the "break" in the economy has occurred and that there will be a halt to interest rate hikes during the Fed meeting on 22 March 2023.

Harsh Reality - Even though it's painful, the market needs this; and the Fed needs to continue to push interest rates higher to break inflation.

The absolute last thing the U.S. economy needs is to have a two year battle with inflation while it sits at 6%-7% because drastic efforts are not taken to reduce it. Thus far, the Fed has been extremely hawkish raising the Fed Funds rate from 0% to 4.7%, a 20x increase; however, inflation has stayed extremely high.

The vast majority of people don't know anything about inflation or how it affects them. To put it in the simplest terms, the $100 you had in your bank account last year, now has the buying power of $93-$94. That reduction in buying power will continue compounding every year until this problem is fixed. The hike in interest rates also cause everything from home mortgages to credit cards to go up. Right now a person with an excellent credit score is sitting at a 28%-32% interest rate on consumer debt (credit cards). The rates only get worse as the FICO scores go down.

It's easy to see how this affects every day people. The thing to remember is that it affects businesses even more. Most businesses are purchased or expanded with debt. Unfortunately, there are very few (or none) commercial debt instruments that are long-term fixed rates. So the price of their commercial mortgages, or business debt adjusts to the fair market rate. Some amortization schedules are five or ten years; but some are six months to two years. The businesses who took on that short term debt could be in extreme danger as their interest rates explode.

*Enter Opportunity* Baron Rothschild, a member of the infamous (and likely the wealthiest) Rothschild family, is quoted as saying, "Buy when there's blood in the streets, even if that blood is your own." Well my friends, get ready. The opportunity to purchase assets at an extreme discount are coming!

Inglorious Bastards GIF - Credit Tenor

Next week we're going to get into the fun stuff. How to buy assets!

Were you ever taught about that practical impacts of inflation? |

Shit That Matters

Bank Collapse/Crisis - This week in the U.S., three banks collapsed, prompting a huge market sell-off and "run on the banks."

Run on SVB - Credit NBC

Harsh Reality - The Department of the Treasury has handled this like sh!t.. Instead of letting the market run its course, they decided to use the Federal Deposit Insurance Corporation (FDIC) to guarantee all deposits in Signature and SVB. FDIC insurance is typically limited to $250,000 per depositor. Some depositors in SVB had billions at risk; which is financial stupidity 101.

Supporters of the move will say that they had no choice because depositors would go bankrupt; however, we have evidence to show that that's not true. The Bank of England (Rothschild Family) brokered a sale of SVB UK Branch to HSBC for £1.00. HSBC used their own liquidity to ensure that depositors had access to capital and business continued on. Compare that to the banking system nationalization that occurred in the U.S.

Joe Biden came out in usual fashion and blamed the previous administration for the issues. Then, both Janet Yellen and Biden came out and stated that no tax payer funding will be used in their bailout of SVB and Signature Bank. Of course, Pinocchios abound as usual.

Biden was referring to the suspension of the Dodd-Frank regulations by Trump in 2022. Unfortunately for Biden, Dodd-Frank regulations would have had no impact on this situation; but they're playing to voter ignorance. In fact, Barney Frank, the retired congressman who coauthored the Dodd-Frank act, was one of the sitting board members at Signature Bank when it collapsed.

SLJ Stares Motherfuckerly - Credit - Tenor

Ref. tax payer funding, Biden and Yellen have stated that their intention is to levy a "special FDIC assessment" on banks who did not collapse to cover the bill. A few issues are at play there:

They're rewarding tech companies and punishing banks who acted responsibly.

They're assuming that the "special assessment" will cover the depositor value of all of the banks; and that the funding will become available in a timely manner.

They just gave every bank in the U.S. permission to take on more risk.

The FDIC has zero cash reserves left after this move. The assumption is that the U.S. government will backstop them; but how long will that last if banks continue to collapse? The value of all U.S. deposits tops $19T at the time of this writing.

All additional costs of doing business incurred by banks will ultimately be passed along to their customers (you). So while "tax money" won't be used, tax payers' money will definitely be used.

It is worth noting that Janet Yellen was a member of the San Francisco Fed and those Tech business relationships have likely had undue influence on her decisions. SVB's customer base was mainly tech companies, 93% of which had deposits that far exceeded the FDIC insurance limits. Some well known names who were caught up in the SVB collapse were Roku, Etsy, RoBlox, etc.

Are you interested in a deep dive on the why & how these bank collapses have occurred?All the nerd speak and technical data that led to these failures. |

Bank Crisis Has Gone Global - Credit Suisse's market value has tanked due to the financial statement they published early this week. By their own fruition, they have found "material weakness" in their financial reporting.

Just Gonna Invest In Some Bank Stonks.. - Credit Tenor

Harsh Reality - Their main investor is jumping ship. Credit Suisse made a public statement that if their liquidity was in danger that they would simply borrow more money from their largest investor, the Saudi National Bank. The SNB came out and stated that that would not be happening. Not only due to additional regulatory requirements if they acquired more than 10% of the bank; but also because it would be a horrible investment.

The Swiss Central Bank took a queue from the U.S. Treasury Department and stated that they would ensure the liquidity of Credit Suisse. The value of this bank is $574B, twice that of Silicon Valley Bank. A collapse of Credit Suisse would have a huge impact on the markets.

Russo-Ukrainian War - The Russians continue their push for Bakhmut while the Ukrainians' position is becoming more dire by the day.

Harsh Reality - The Ukrainians are fighting a losing battle in Bakhmut. It's likely that they will have a mass capitulation of over 5,000 personnel there. The entire resistance pocket is less than 4km wide which almost puts the Russian encircling forces in small arms range of each other. In other words, every Ukrainian in Bakhmut can be targeted in real time.

Along with that, the Russians are continuing to play "just the tip" with the NATO forces in the area and it's very dangerous. This week one of their Su-27 fighters tried to douse a U.S. MQ-9 Reaper Drone with fuel; which resulted in a mid-air collision. The $30M Reaper then crashed into the Black Sea and is a total loss.

Of course we've heard little from the Biden administration on this. Preventing a kinetic exchange with a nuclear superpower might be on the top of my list if I were in that position.

A basic response could be as simple as a statement outlining the following:

"Any NATO aircraft operating near the Ukraine conflict area will now enforce a 1 mile buffer between themselves and any Russian aircraft. If any Russian aircraft violates that buffer then their intentions will be interpreted as hostile and they will be shot down."

It's a 100% defensive statement; but is also a strong response that will put an end to all of the grab-assing. It's literally that easy..

1,000 Illegal Immigrants Storm Border Crossing - Over 1,000 migrants attempted to storm the Paso Del Norte Bridge in El Paso, TX. They were met by border protection agents in riot gear who prevented a mass incursion.

Harsh Reality - Unfortunately, this is becoming a common sight down at the border. From cartel mules to people looking for better opportunities, the pressure on the southern border has never been higher. This issue has also become extremely politicized in D.C. Kamala Harris (the border czar) has done absolutely nothing to prevent these issues and very little support has been provided to the Border Patrol.

Weekly Market Recap

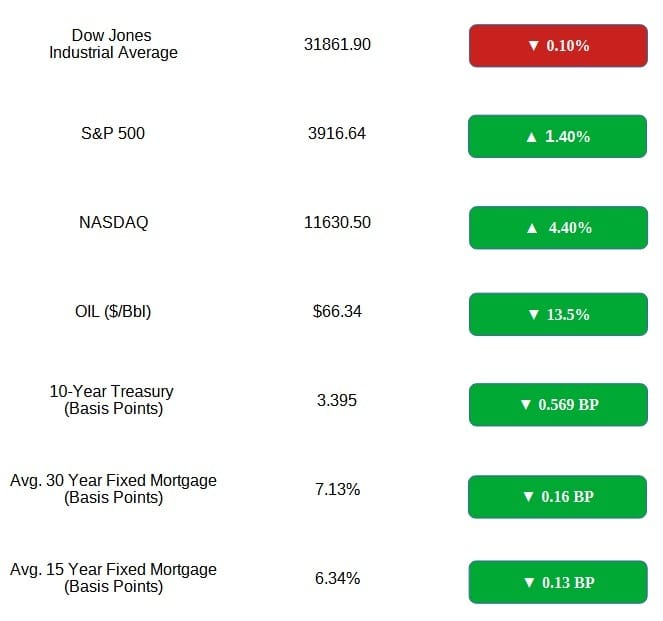

** Weekly Market Recap - As of Market Close 17 March 2023

Shit That Doesn't Matter

Biden Influence Peddling - The Congressional Oversight Committee has received access to over 100 financial Suspicious Activity Report (SARs) from the Treasury Department.

Hunter - Credit - Leaked Laptop Image

Harsh Reality - If anything actionable comes from the Congressional Oversight Committee, Joe Biden will be raining pardons like Hunter Biden rains Chinese bribe money at the strip club. He and the entire Biden family will be protected from anything actually occurring. Hell, Hillary Clinton isn't even in jail and the FBI stated on a live broadcast that she broke the law numerous times. Any other person in the world would be in jail for decades over what she did.

U.S. Threatens TikTok Ban - The Biden administration has threatened to ban TikTok if the Chinese parent company doesn't sell its ownership stake in the company.

Harsh Reality - Good luck with that. Disregarding the huge tech interests at play here, there is a 0% chance that Biden is going to ban the most popular app in the U.S. during an election season.

French Riot Over Retirement Age - The French President Macron forced the implementation of highly controversial legislation, without a parliamentary vote, changing the national pension qualification age from 62 to 64. French citizens are rioting in response.

Mostly Peaceful French Riots - Credit USA Today

Harsh Reality - The mostly peaceful riots (sarcasm) are a nice show; but the people of France are disarmed & have no real teeth to hold anyone accountable. There is a chance that a vote of no-confidence can be held and if passed it will be the first time since 1962. That will not save the national pension fund from insolvency which is why Macron forced the legislation forward.

People in the U.S. are mostly confused at the idea that everyone can retire at 62..

That's A Wrap!

Thank you for taking the time to read this edition of "Harsh Reality." Each edition will only get better going forward so if you got value from this content please consider inviting your friends and family to subscribe using the link below. Once we make it to 10,000 subscribers this will transition from a weekly to a daily newsletter and we need your help to get there!

We also added Twitter to our social media portfolio so please follow us there. Not sure if it's worth $8.00, but our founder will be the only one tweeting under the nom de guerre "@HarshActual." Also, hit us on our Facebook page, YouTube channel or Discord server to keep the conversation going! We welcome your feedback and discussion!

How was this week's edition of Harsh Reality?Be Honest!!! Send comments & criticisms to [email protected] |

Reply